Are you looking to take your crypto trading to the next level? Then you’ve come to the right place! In this post, we’ll be covering 10 essential crypto trading tools that every successful trader should have in their arsenal. We’ll dive into topics such as how to choose the right trading tools for your needs, the benefits of using crypto trading tools, and how to maximize your profits using these tools. We’ll also explore essential technical analysis and risk management tools, and take a closer look at how automated trading tools can help you trade more efficiently. From identifying trends and market movements to day trading and professional trader tools, we’ve got you covered. So, whether you’re a beginner or an experienced trader, get ready to take your crypto trading game to the next level with these essential trading tools!

How to Choose the Right Crypto Trading Tools for Your Needs

As a crypto trader, selecting the right trading tools is essential to your success. With so many options available, it can be challenging to determine which tools are the best fit for your needs.

When selecting trading tools, it’s important to consider your trading style, goals, and experience level. For example, if you’re a day trader, you may want to focus on tools that provide real-time data and charting capabilities. On the other hand, if you’re a long-term investor, you may be more interested in tools that offer portfolio tracking and management features.

It’s also important to consider the reliability and security of the trading tools you choose. Look for tools that are trusted and reputable in the crypto community and have a track record of providing reliable and secure services.

The Benefits of Using Crypto Trading Tools

Using crypto trading tools can provide a range of benefits to traders. These tools can help simplify the trading process, provide real-time data and analysis, and automate trades to maximize profits.

One significant advantage of using trading tools is the ability to access real-time market data and analysis. This data can help traders make informed decisions about when to buy or sell their assets, based on market trends and movements. Trading tools can also provide technical analysis, such as charting and indicator tools, to help traders identify potential price movements and market patterns.

Another benefit of using trading tools is the ability to automate trades. Automated trading tools can help traders execute trades based on predetermined parameters, such as price points or market movements. This can help traders take advantage of market opportunities, even when they’re not actively monitoring the market.

Maximizing Your Profits: The Role of Crypto Trading Tools

Crypto trading tools can help traders maximize their profits by providing access to real-time data and analysis, automating trades, and managing risk.

One way trading tools can help maximize profits is by providing access to real-time market data and analysis. This data can help traders make informed decisions about when to buy or sell their assets, based on market trends and movements. Trading tools can also provide technical analysis, such as charting and indicator tools, to help traders identify potential price movements and market patterns.

Automated trading tools can also help maximize profits by executing trades based on predetermined parameters, such as price points or market movements. This can help traders take advantage of market opportunities, even when they’re not actively monitoring the market.

Risk management tools are also essential for maximizing profits in crypto trading. These tools can help traders set stop-loss orders, limit orders, and other risk management measures to minimize losses and protect profits.

Essential Technical Analysis Tools for Crypto Trading

Technical analysis is a key component of successful crypto trading, and there are a variety of tools available to help traders analyze market trends and movements.

Charting tools are one essential technical analysis tool for crypto trading. These tools can help traders visualize market data and identify trends and patterns over time. Popular charting tools include TradingView and Coinigy.

Indicator tools are also important for technical analysis in crypto trading. These tools use mathematical calculations and statistical analysis to provide insights into market movements and potential price changes. Popular indicator tools include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

Overall, technical analysis tools can help traders make more informed decisions about when to buy or sell their assets, based on market trends and movements.

Risk Management Tools for Crypto Trading: Why You Need Them

Risk management is a critical aspect of successful crypto trading, and there are several tools available to help traders

manage risk in their trades.

Stop-loss orders are one important risk management tool. These orders automatically sell an asset if its price falls below a certain point, helping traders minimize losses in the event of a market downturn.

Another risk management tool is a limit order, which allows traders to set a specific buy or sell price for an asset. This can help traders ensure that they buy or sell an asset at the price they want, even if the market is moving quickly.

Risk management tools can also help traders manage their overall portfolio risk. Portfolio tracking and management tools can provide insights into the diversification and balance of a trader’s portfolio, helping them identify and mitigate potential risks.

Trading Bots: How They Work and Their Benefits

Trading bots are automated software programs that execute trades based on predetermined parameters. These bots can help traders take advantage of market opportunities, even when they’re not actively monitoring the market.

Trading bots work by analyzing market data and executing trades based on predetermined parameters, such as price points or market movements. They can also be programmed to execute trades based on technical analysis tools, such as moving averages or Bollinger Bands.

The benefits of using trading bots include the ability to automate trades, maximize profits, and manage risk. Trading bots can also help traders take advantage of market opportunities in real-time, even when they’re not actively monitoring the market.

However, it’s important to note that trading bots are not foolproof and can still result in losses. Traders should use caution when using trading bots and ensure that they understand the risks involved.

Portfolio Tracking and Management Tools: Why They’re Important

Portfolio tracking and management tools can help traders manage their overall portfolio risk, diversification, and balance.

These tools can provide insights into the performance of a trader’s portfolio, including asset allocation, profit and loss, and other metrics. This can help traders make informed decisions about their trades and identify potential risks or opportunities.

Portfolio tracking and management tools can also help traders ensure that their portfolio is balanced and diversified. This can help mitigate risk and ensure that a trader’s assets are spread across different asset classes and industries.

Overall, portfolio tracking and management tools are essential for any crypto trader looking to manage their risk and maximize their profits.

News and Social Media Analysis Tools: How They Can Inform Your Trades

News and social media analysis tools can provide insights into market sentiment and potential market movements.

These tools can analyze news articles, social media posts, and other online content to identify trends and sentiment around different assets or industries. This can help traders make more informed decisions about their trades and identify potential market movements.

However, it’s important to note that news and social media analysis tools are not foolproof and can still result in losses. Traders should use caution when using these tools and ensure that they understand the risks involved.

Wallets and Security Tools: Protecting Your Crypto Assets

Wallets and security tools are essential for protecting your crypto assets from theft or loss.

Crypto wallets are digital storage solutions that allow traders to securely store their crypto assets. There are several types of wallets available, including hardware wallets, software wallets, and online wallets.

Security tools, such as two-factor authentication and encryption, can also help protect crypto assets from theft or loss.

It’s important for traders to prioritize security when managing their crypto assets, as the crypto market is vulnerable to hacking and other security breaches.

Community and Education Tools: Connecting with Other Traders and Learning

Community and education tools can provide valuable resources and connections for crypto traders.

Online communities, such as forums or social media groups, can provide opportunities for traders to connect with other traders and share insights and strategies. Education tools, such as online courses or webinars, can provide valuable insights into crypto trading and help traders develop their skills and knowledge.

It’s important for crypto traders to stay up-to-date with the latest trends and developments in the industry, and community and education tools can provide valuable resources for doing so.

Overall, these 10 essential crypto trading tools can help traders manage risk, maximize profits, and stay up-to-date with the latest market trends and developments. By incorporating these tools into their trading strategies, crypto traders can improve their chances of success in the volatile and fast-paced crypto market.

While it is profitable, it can be highly pernicious to your financial health if not done properly.

By properly, I mean doing it with the right mindset with the right set of tools such as market watcher, portfolio manager, Crypto trading journaling tool, low-cost trading exchanges, charts, crypto news aggregator, and finally reliable exchanges where you can actually trade.

Here is the list of cryptocurrency trading tools listed below:

- 3Commas (Single terminal for smart trading, Read 3commas review)

- Koinly (Crypto Portfolio & taxation tool)

- Binance (The best low-cost exchange for trading, read Binance review)

- Altfins

- Shrimpy (Read Shrimpy review)

- Altrady

- TradeSanta

- Ledger Nano X (Most secure crypto hardware wallet)

- Bitfinex

- CoinMarketCap

- CoinGecko

- CoinMarketCal

- CryptoPanic

- CoinMarketMan (Most sophisticated journaling tool)

- Bonus

That is why, to make the crypto world a safer, more profitable space for all our readers, we have compiled a list of 13 highly recommended crypto trading tools.

Top Cryptocurrency Trading tools for Beginners and Professionals

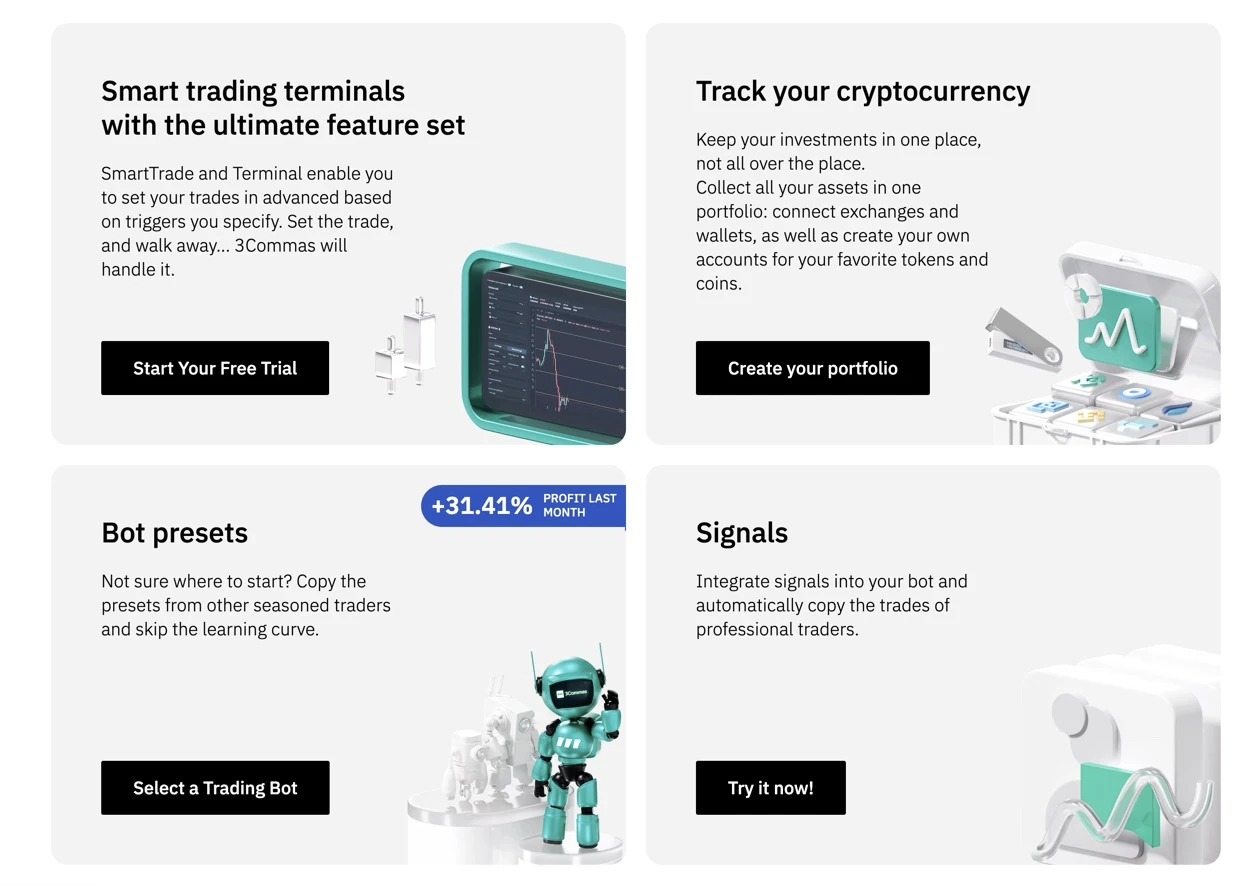

1. 3commas

3commas offers a lot of features and the most liked one is the Trading terminal.

You can connect to cryptocurrency exchanges like Binance, Bittrex, Poloniex through a single interface of 3commas and make your trading decisions on each of them simultaneously.

Plus, you can get smart trading features such as trailing stop-loss and trailing take-profit which enables one to maximize their profits in real-time.

Apart from these,

3commas is a modern-day crypto trading bot and portfolio balancer which helps crypto traders like you and me make the most out of their trades.

- Read more: 3Commas review: How to use 3Commas

Also, with 3commas you can do social trading by copying portfolios of already successful traders who are consistently having decent portfolio growth.

2. Koinly

Koinly is a crypto portfolio manager for beginners and advanced users alike.

We have been using this manager for quite some time now and are really impressed with its features.

With Koinly you can track your cryptocurrencies on various exchanges and be perpetually aware of what coins you have in your portfolio.

It also provides intuitive graphs and charts based on your portfolio holdings and market movements so that you can make educated decisions.

It is a paid tool that is available on the web.

3. Binance

Now that you have seen portfolio balancers, portfolio managers, crypto wallets, it makes sense in looking at one of the most prominent crypto exchanges that have set a new benchmark for the whole trading exchange industry.

Binance is one of the world’s top three exchanges. And to your surprise and mine, it is not even two years old in the business.

The team behind Binance is amazing and heavily focused on serving its trading customers. That’s why they launch innovative airdrops, competitions, and prizes regularly for their traders.

Plus, their trading fee is the lowest in the industry at 0.1%, on which also you can get a 50% discount if you use their native BNB tokens to pay the trading fees.

4. Altfins

Altfins is a crypto-screener app and market analyzer tool that will help you identify highly profitable trades in record time. It could help you save 30% of the trading time and assist by identifying chart patterns in your selected crypto-assets.

Many of you might not have heard about Altfins, as the platform might not seem that appealing at a single glance. But, as you start learning and using the platform, you will be surprised by the features it offers.

For example, have a look at the below screenshot of Altfins homepage, and in a single glance you can find a ton of trading opportunities.

However, if you are like me; and prefers to trade in the coins that are in our watchlist, you can do that too with Altfins.

You can create your own watchlist of coins, and use this tool to quickly identify profitable trading opportunities.

There are more features that you will find this tool worth your time investment, and I would not be surprised if it becomes one of your go-to tools for crypto trading.

Here are some of the things you could do with Altfins –

- Quickly identify the trend of a coin

- Analyze entire crypto market to identify trading opportunity

- Connect with your exchange using API, and analyze only your portfolio for the trading oppurtunities

- It also offers trading via API feature (Which is not that great)

- On-chain data

- Track market news

And a lot of more features which I let you discover of your own.

Overall, I highly recommend you to spend 1-2 hours learning the features of Altfins, and if you end up using it, do come back to say thank you.

5. Shrimpy

Shrimpy is another crypto software that enables you to diversify, automate, and earn from cryptocurrency investments.

We all know about HODLing but a new concept of rebalancing introduced by Shrimpy even works better as it automatically helps to buy low and sell high.

Crypto whales use the rebalancing technique to minimize risk and maximize their profits irrespective of market conditions.

How it works:

Once you schedule your rebalancing cycle in hours, days, or weeks, Shrimpy will automatically buy/sell cryptocurrencies in each cycle that are performing as per your goal/classification.

Of course, for this, you need to integrate your exchanges with Shrimpy and it is quite easy to do so. Here are two of our guides where we have shared our experience of using Shrimpy:

- Shrimpy: Now, Automatically Balance Your Cryptocurrency Portfolio For Free

- Top Crypto Portfolio Rebalancing Tools (Automated & Manual)

6. Altrady

I guess if you are using Binance and Bitfinex then you have almost covered more than 50% of the crypto market.

But if you are someone who wants to dig deeper and increase their reach as well as reduce their risk by using several exchanges then Altrady is for you.

Using Altrady one can trade on multiple exchanges from a single account and trade hundreds of currencies from their palm with Altrady’s mobile app.

You can access real-time updates, alerts, and charts from various exchanges from where you can buy different cryptocurrencies.

In this way, you will diversify even your exchanges by buying/selling different cryptocurrencies at different exchanges, therefore reducing your risk of being exposed to one or two exchanges.

Featured of Altrady:

- Smart Trading

- Real-Time Market Data and Alerts

- Multiple Exchanges

- Scaled Ladders

- Market Scanners

- Desktop app (Also available on cloud)

- Trading Analytics

- Positions with P&L

- Crypto Journaling

- Portfolio Manager

- Mobile apps

- Coinigy import

These features don’t come for free as there is a standard fee for monthly and annual subscriptions but the trial version is available for a month free of cost.

7. TradeSanta

TradeSanta is a Crypto trading bot that automates crypto trading and helps you make a profit even when you sleep. Another interesting thing behind TradeSanta is it is suitable for newbies as all you are doing is creating a long and short position.

Getting started is easy, and all you need to do is connect TradeSanta with a supported exchange using API and then you can start with minimum investment. Even $50 is a good start to test out this free Bot.

At the time of writing, the following exchanges are supported:

- Binance

- Bittrex

- Bitfinex

- HitBTC

The following exchanges will be supported soon:

- BitMex

- Huobi

The help guides and videos will help you understand how to use TradeSanta and you can get started with automated crypto trading within less than 30 minutes.

8. Ledger Nano X

Ledger Nano X is the most popular cryptocurrency hardware wallet in the market.

If you are someone who is serious about cryptocurrencies and its long-term value, you MUST have Ledger Nano X at your disposal.

Ledger Nano X currently supports more than 150000 cryptocurrencies. Plus, it is an HD wallet that is quite popular in the cryptosphere.

9. Bitfinex

Bitfinex is another popular cryptocurrency exchange that has made a mark in very little time.

An experienced team of traders and developers who have previous experience running crypto exchanges runs it.

Here you can find some of the rare cryptocurrency gems that you would otherwise not find anywhere else.

Just like Binance, they offer a fully functional mobile app for Android and iOS. And also have their own native token called LEO, holders of this token get discount on trading fees.

Apart from this benefit, their fee structure of trading is rather cheap with only 0.1% as the trading fees.

10. CoinMarketCap

CoinMarketCap needs no introduction unless it is your first day in the world of crypto.

This is one of the most visited websites in the cryptosphere and that’s because it tracks prices, market cap, volume, listings of coins and tokens in this space.

Furthermore, it shows prices, volume, and other data in 13 languages and 28 national currencies. It also saves historical price charts of crypto markets and provides you with real-time charts for BTC and the whole crypto market.

It has APIs and widgets, social, and markets section for each coin/token which makes things easier for traders to make decisions quickly.

Also see: 5 Best Alternatives To CoinMarketCap

11. CoinGecko

CoinGecko is another price and volume tracker website that does the same job as CoinMarketCap.

Well, why use it when it is the same as CoinMarkeCap, you may ask.

That is because it is not a good practice to rely on centralized systems like this for decentralized markets.

With CoinGecko you can see and track prices of 100s and 1000s of cryptocurrencies in fiat and BTC with appealing charts of different intervals. One can also see CoinGecko UI in 15 different languages apart from English which is a huge plus point for any website in this niche.

12. CoinMarketCal

CoinMarketCal is a valuable tool in your armory if you are trading futures.

Here are top features of CoinMarketCal

- Event calendar: Lists upcoming events related to various cryptocurrencies, such as product launches, partnership announcements, and conferences.

- Event submission: Allows users to submit events for inclusion on the calendar.

- Event verification: Utilizes a community-driven verification system to ensure that events are legitimate and accurately described.

- Event filtering: Allows users to filter events by date, cryptocurrency, and event type.

- Event reminders: Allows users to set reminders for upcoming events of interest.

- Event ratings: Allows users to rate events based on their impact on the cryptocurrency’s price.

- User accounts: Allows users to create accounts to save their preferences and set event reminders.

- Mobile-friendly: Optimized for viewing on mobile devices.

It is a must-have tool to be used while making your crypto strategy and the good thing is that it is totally free to use.

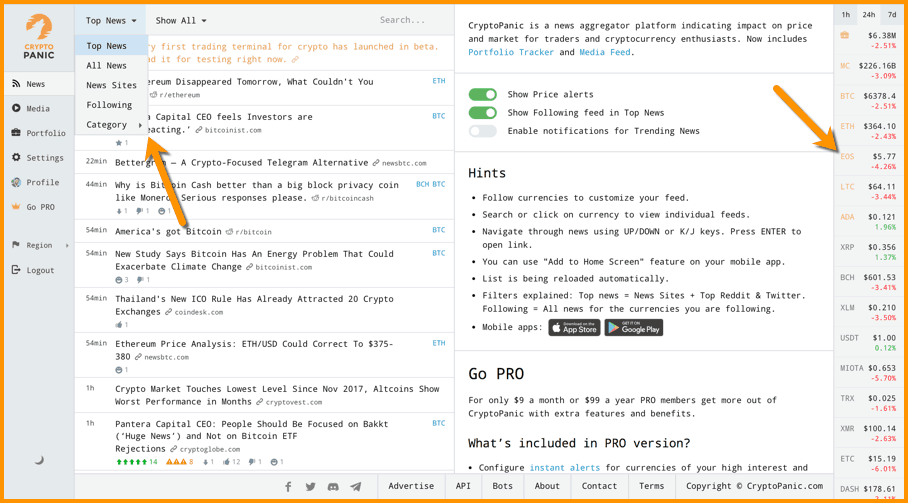

13. CryptoPanic

CryptoPanic is another favorite tool of mine that helps me stay on top of the news from the cryptosphere.

Crypto is a relatively a small market which is highly influenced by news. That’s why it becomes important to know the news and then gauge the sentiments of the market.

This helps in solidifying your crypto strategy.

With CryptoPanic’s free version, you can follow highly customized news according to the coins you are interested in.

Plus, you can get the feature to follow your chosen YouTube channels, Reddit thread and Twitter accounts to accurately gauge the sentiments of the market.

14. CoinMarketMan

CoinMarketMan is the most sophisticated crypto trading journaling app you can use now. It works with almost all the popular crypto derivatives trading exchanges, such as Binance, Bybit, to name a few. It also works with spot, margin, and future markets.

Coin Market Manager automatically imports the trades from connected exchanges and helps you analyze your trading setup and your overall win and loss. For a serious crypto trader, this tool helps in understanding which setup is working best for you, and helps you in improving your overall crypto trading setup.

If you are a beginner, you may not realize the importance of trading journaling, but this is something that you should use , and once you are accustomed to journaling, you will understand the benefit of it.

Note: In the V2 of CoinMarketMan, they removed the automated journaling option for spot exchanges. For now, this platform is ideal only for derivatives traders.

Here are the top exchanges supported by CoinMarketMan:

CoinMarketman is a paid tool, however they do offer a free trial which is good enough for you to understand the benefit and test all the features offered by this sophisticated crypto trading tool.

15 – Trading View

Trading View is a highly rated charting software that is quite popular in the world for showing accurate market charts for commodities, stocks, derivatives, and now crypto also.

So if you are someone who likes technical analysis of coins by looking at charts of different intervals, this tool is for you.

Moreover, to aid you will find all the latest and traditional patterns analysis tools inbuilt in trading view software.

Here are top FAQ’s related to crypto trading tools:

Which software is best for crypto trading?

Binance is the widely used software for trading crypto. It is available in almost all parts of the world except the USA, the UK, and a few more sanctioned countries. Users from the USA and UK can use Kraken, another popular crypto trading app.

Can I automate crypto trading?

Yes, you can automate crypto trading using one of these automation apps such as:

3Commas

Bitsgap

Pionex

Upcoming Crypto trading tools & Software:

These are some of the tools which are upcoming, and they are worth watching. Some of them may develop into a mainstream tool or some of them may shut down. Either way, these projects are doing something significant and would help you in picking better trade:

- Trading room tools:

Well, I am sure no one would have access to all the tools. Don’t worry. When I started off, I didn’t have all this either, but with the time you can start adopting one thing at a time to take your crypto trading skills to the next level.

Now, it’s your turn to try out these tools and share your experience in the comments section below.

Conclusion:

In conclusion, crypto trading can be a challenging and volatile market, but by incorporating the essential crypto trading tools discussed in this post, traders can manage risk, maximize profits, and stay up-to-date with the latest market trends and developments. From charting and analysis tools to security and community resources, each of these tools serves a unique purpose in the crypto trading world. By taking advantage of these essential tools, crypto traders can position themselves for success in this exciting and ever-evolving market. So, whether you’re a seasoned crypto trader or just getting started, make sure to consider these essential crypto trading tools as part of your trading strategy.

FAQ:

Q: What are some of the essential crypto trading tools? A: Some essential crypto trading tools include charting and analysis tools, order execution tools, risk management tools, trading bots, portfolio tracking and management tools, news and social media analysis tools, wallets and security tools, and community and education tools.

Q: Why are charting and analysis tools important for crypto traders? A: Charting and analysis tools allow traders to analyze market trends and patterns, identify potential buying and selling opportunities, and make informed trading decisions based on data and analysis.

Q: What are some popular charting and analysis tools for crypto traders? A: Some popular charting and analysis tools for crypto traders include TradingView, Coinigy, and Cryptowatch.

Q: What are order execution tools? A: Order execution tools allow traders to place and execute orders quickly and efficiently. These tools can help traders take advantage of market opportunities and minimize trading delays.

Q: How can risk management tools help crypto traders? A: Risk management tools can help traders manage risk in their trades, minimize losses, and protect their investments. Some examples of risk management tools include stop-loss orders and limit orders.

Q: What are trading bots? A: Trading bots are automated software programs that execute trades based on predetermined parameters. These bots can help traders take advantage of market opportunities, even when they’re not actively monitoring the market.

Q: What are portfolio tracking and management tools? A: Portfolio tracking and management tools provide insights into the performance of a trader’s portfolio, including asset allocation, profit and loss, and other metrics. These tools can help traders make informed decisions about their trades and identify potential risks or opportunities.

Q: How can news and social media analysis tools inform crypto trades? A: News and social media analysis tools can provide insights into market sentiment and potential market movements. These tools can help traders make more informed decisions about their trades and identify potential market opportunities.

Q: Why is security important for crypto traders? A: The crypto market is vulnerable to hacking and other security breaches, so it’s important for traders to prioritize security when managing their crypto assets. Security tools, such as two-factor authentication and encryption, can help protect crypto assets from theft or loss.

Q: What are some community and education tools for crypto traders? A: Online communities, such as forums or social media groups, can provide opportunities for traders to connect with other traders and share insights and strategies. Education tools, such as online courses or webinars, can provide valuable insights into crypto trading and help traders develop their skills and knowledge.

Sources:

- “The Best Crypto Trading Tools: Charts, Portfolio Trackers, and More.” CoinCentral, https://coincentral.com/best-crypto-trading-tools/.

- “The Top 3 Charting Tools for Crypto Traders.” CryptoSlate, https://cryptoslate.com/the-top-3-charting-tools-for-crypto-traders/.

- “The Top 5 Crypto Order Execution Tools.” Crypto Briefing, https://cryptobriefing.com/top-5-crypto-order-execution-tools/.

- “Crypto Trading Bots: Are They Worth It?” Forbes, https://www.forbes.com/sites/jessedamiani/2018/08/08/crypto-trading-bots-are-they-worth-it/?sh=5cb178c0656e.

- “The 6 Best Portfolio Management Apps for Cryptocurrency Investors.” BlockFi, https://blockfi.com/blog/the-6-best-portfolio-management-apps-for-cryptocurrency-investors/.

- “Crypto News and Social Media Monitoring: A Guide for Traders.” Cointelegraph, https://cointelegraph.com/news/crypto-news-and-social-media-monitoring-a-guide-for-traders.

- “Top 10 Crypto Security Tips.” Ledger, https://www.ledger.com/top-10-crypto-security-tips.

- “10 Crypto Trading Communities to Join.” CoinDiligent, https://coindiligent.com/crypto-trading-communities-to-join.

- “7 Best Crypto Trading Courses in 2021.” Benzinga, https://www.benzinga.com/money/best-crypto-trading-courses/.

- “Crypto Trading for Beginners: Top 5 Resources.” Investopedia, https://www.investopedia.com/articles/active-trading/080715/cryptocurrency-trading-beginners.asp.