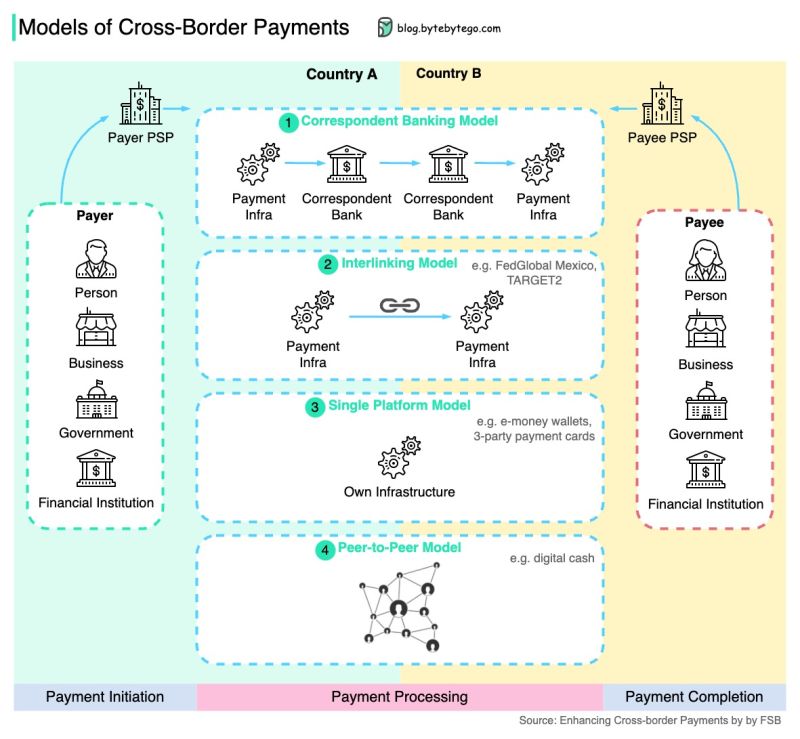

▶️ 1. 𝐂𝐨𝐫𝐫𝐞𝐬𝐩𝐨𝐧𝐝𝐞𝐧𝐭 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐦𝐨𝐝𝐞𝐥

The correspondent bank holds deposits owned by other banks from other countries. This allows banks to access financial services in different jurisdictions.

Under some international card schemes (VISA, Mastercard), participating banks typically rely on correspondent banking for settlement. [1]

▶️ 2. 𝐈𝐧𝐭𝐞𝐫𝐥𝐢𝐧𝐤𝐢𝐧𝐠 𝐦𝐨𝐝𝐞𝐥

This enables PSPs (Payment Service Providers) participating in the payment infrastructure of one country to send and receive payments to/from PSPs participating in another country’s infrastructure.

Interlinking can be costly and complex from a legal, operational and technical point of view, and therefore has generally only been set up between countries with considerable economic activity between them and/or migration flows. [1]

▶️ 3. 𝐒𝐢𝐧𝐠𝐥𝐞 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐦𝐨𝐝𝐞𝐥

PSP of the payer is the same entity (or part of the same group) as the PSP of the payee. This can be the case for proprietary arrangements (e.g. traditional money transfer operators), some international card schemes (i.e. “3-party model”) and e-money schemes, or multinational banks that are present in the payer’s and the payee’s country. [1]

▶️ 4. 𝐏𝐞𝐞𝐫-𝐭𝐨-𝐩𝐞𝐞𝐫 𝐦𝐨𝐝𝐞𝐥

The peer-to-peer model cuts out the financial intermediary PSP and enables the payer to send the payment directly to the payee. For example, sending crypto assets over blockchains falls into this category.

▶️ 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐨𝐟 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐚𝐫𝐝𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Cross-boarder payments are 𝐚𝐜𝐫𝐨𝐬𝐬 𝐣𝐮𝐫𝐢𝐬𝐝𝐢𝐜𝐭𝐢𝐨𝐧𝐬. Different countries have different payment regulations, and different payment processing and clearing systems.

We need a way to 𝐢𝐧𝐭𝐞𝐫𝐨𝐩 among the information flow and fund flow. So that’s why we have different models to address this issue.

Reference:

[1] Enhancing Cross-border Payments by by FSB

—

#systemdesign #payments #fintech #crossborderpayments #cbdc #blockchain